Connecting Capital to

High-Impact Enterprises

Algora serves as the central nervous system for the impact economy, bridging the critical disconnect between global capital and high-potential enterprises in emerging markets. By digitizing the investment lifecycle, we facilitate the flow of funds to where they can do the most good.

The $8 Trillion Missing Middle Gap

High impact Missing Middle Enterprises (MMEs) are the engines of local economies, yet they face a debilitating capital shortage known as the "Missing Middle." These enterprises are too large for microfinance institutions, yet are considered too small or "risky" for traditional commercial banks and venture capital firms.

The estimated credit gap faced by missing middle enterprises (MMEs), preventing them from scaling operations and creating jobs.

Women-owned businesses face significantly larger financing gaps, often due to systemic bias and lack of collateral.

Traditional due diligence costs range from $50K to $150K, making smaller investment ticket sizes ($50K-$500K) economically prohibitive for investors.

Algora's Integrated Solution

An end-to-end digital ecosystem that streamlines every stage of the investment process, reducing friction and cost.

Sourcing & Due Diligence

Our mission-aligned matching engine and automated workflows reduce sourcing, screening, investment readiness and due diligence costs by 40-60%. Enhanced enterprise profiles with investment readiness documentation and video introductions humanize the data.

Impact Monitoring

Standardized frameworks (SDGs, IRIS+, 2X Challenge) combined with real-time tracking dashboards and automated data collection ensure impact is verified, not just promised.

Portfolio Reporting

Unified financial and impact dashboards produce multiple compliance-ready reports and customizable stakeholder/funder reporting templates, saving significant administrative time.

ROI Optimization

Advanced tools for performance pattern identification, scenario modeling, and peer benchmarking to maximize both financial and social returns.

Algora Multiplies Impact Capital

Algora doesn't just connect investors to enterprises—it enhances the investment readiness of enterprises while eliminating friction.

Higher Quality Dealflow

- Instantly matches enterprises to investor mandates

- Improves enterprises to better qualify for investment

- Eliminates mismatches before wasting time

Less time reviewing unsuitable deals. The right match, every time.

Expanding the Market

- Identifies enterprises on the cusp of readiness

- Delivers personalized improvement plans

- Monitors progress with real-time feedback

Creates new qualified opportunities continuously. Increasing the pie, not just slicing it.

Radical Speed & Efficiency

- Automates matching (months to days)

- Pre-populates due diligence data

- Continuous dashboard updates

Significant transaction cost reduction. From months to days, from guesswork to precision.

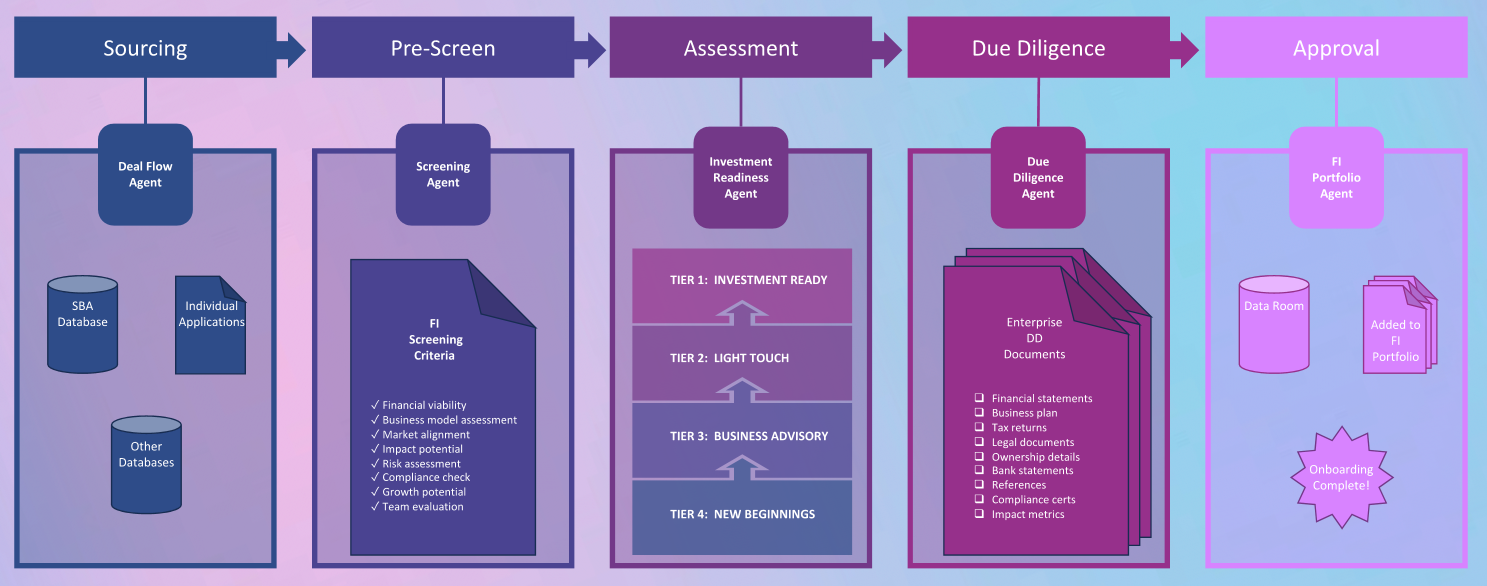

Algora Investment Readiness Agents (AIRA)

AIRA leverages specialized AI agents to progressively help enterprises at all stages become ready for investment, step-by-step. Our four-tier system ensures businesses get the right support at the right time, creating a pipeline of qualified opportunities.

Algora Process and Agential Flow

AI agents trained on specific tasks help users at each step of the way with curated knowledge, streamlining the entire investment lifecycle.

A Multi-Stakeholder Ecosystem

Algora sits at the center of the impact economy, creating tangible value for all participants by reducing friction and enhancing transparency.

Capital Providers (FIs & Funds)

Enterprises (Missing Middle)

Advisors (Service Providers)

SEEF Framework: Measuring Total Returns

We move beyond simple financial metrics to measure impact across four holistic dimensions: Social, Economic, Environmental, and Financial.

Social

Jobs created (gender-disaggregated), income improvements, skills development, and broader community benefits.

Economic

Revenue generation, value chain strengthening, tax contributions to local governments, and new business creation.

Environmental

GHG emissions reduction, resource conservation, renewable energy adoption, and climate resilience strategies.

Financial

Return on investment, capital preservation, risk-adjusted returns, and time to exit for sustainability.

Integrated Standards

Technology That Scales

Technology serves our mission—reducing costs, increasing transparency, and enabling new business models that were previously impossible.

Machine Learning

Risk Assessment

Utilizing alternative data points to score creditworthiness.

Matching Algorithms

Connecting the right investors to the right enterprises.

Fraud Detection

Automated flagging of irregularities.

Benchmarking

Comparative operational analysis.

Distributed Ledger

Immutable Records

Ensuring the integrity of all transaction history.

Smart Contracts

Automating disbursements and compliance checks.

Verified Credentials

Portable trust for enterprises.

Fractional Ownership

Enabling smaller investors to participate.

Cloud Infrastructure

Global Accessibility

Available anywhere with an internet connection.

Mobile-First

Designed for markets where mobile is primary.

API Integrations

Seamless connection with banking and accounting software.

Modular Customization

Adaptable to local needs.

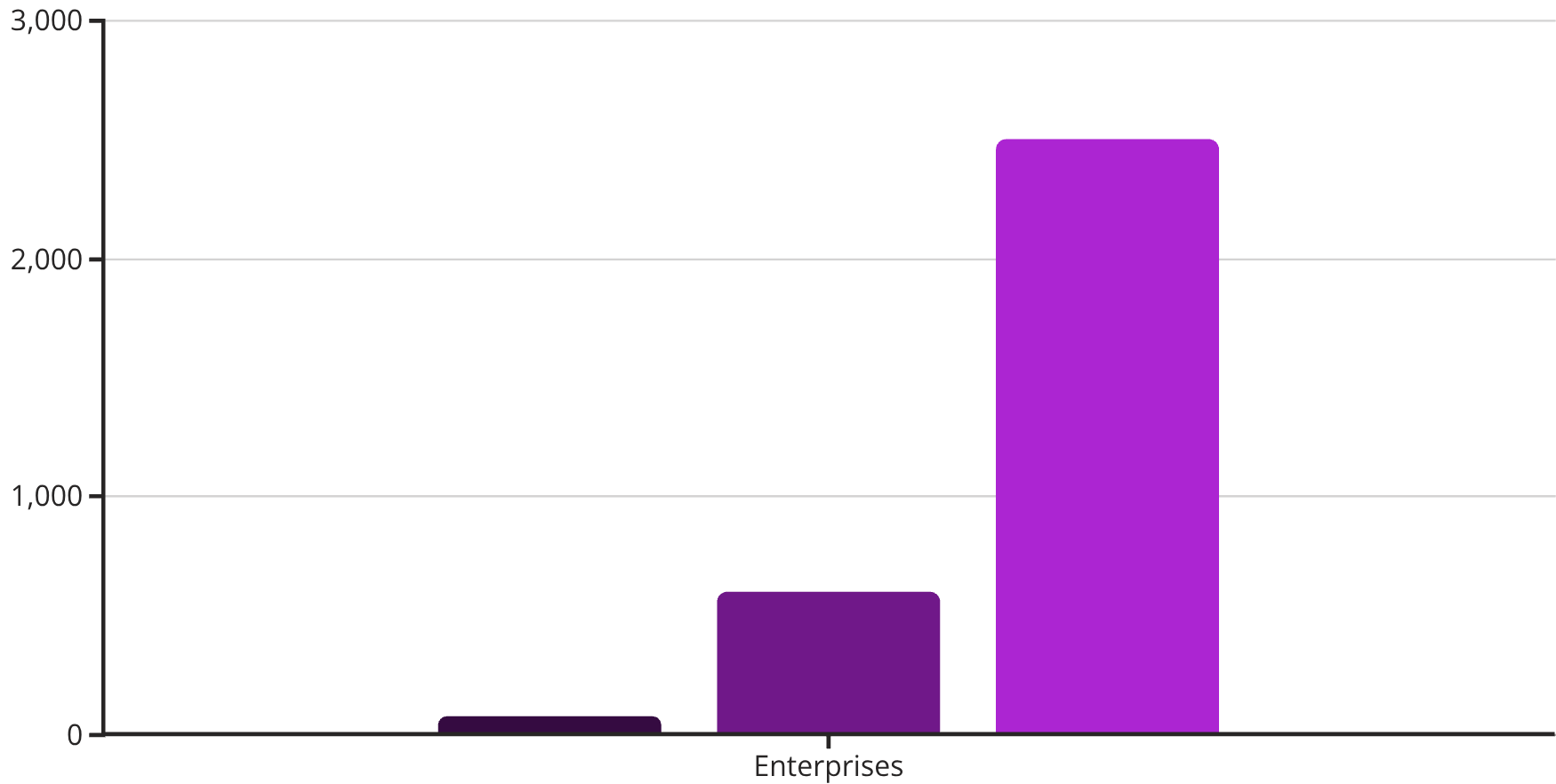

Five-Year Impact Projection

Catalyzing capital at scale to transform the impact investment landscape.

50,000+

Livelihoods improved (direct + indirect jobs)

$150M+

Capital mobilized for Missing Middle Enterprises

500,000

Tons CO2-equivalent emissions reduced

Market-wide

Standards adoption across the ecosystem

Join the Movement

Building Essential Infrastructure for Impact

Algora addresses a $930B gap with technology-enabled scale, strong impact alignment, and catalytic potential

for entire ecosystems. We are not just facilitating deals; we are building the infrastructure for a more

equitable global economy.

For CDFIs and Community Reinvestment Funds

Get the technology solutions needed to scale up mission-aligned dealflows and reduce transaction costs while improving information asymmetry.

Partner NowFor Enterprises

Join Algora to get investment readiness assessment and access financing needed to scale up.

Apply TodayFor Business Advisory Service Providers / Industry Experts

Partner to deliver capacity-building services to a growing pipeline.

Collaborate